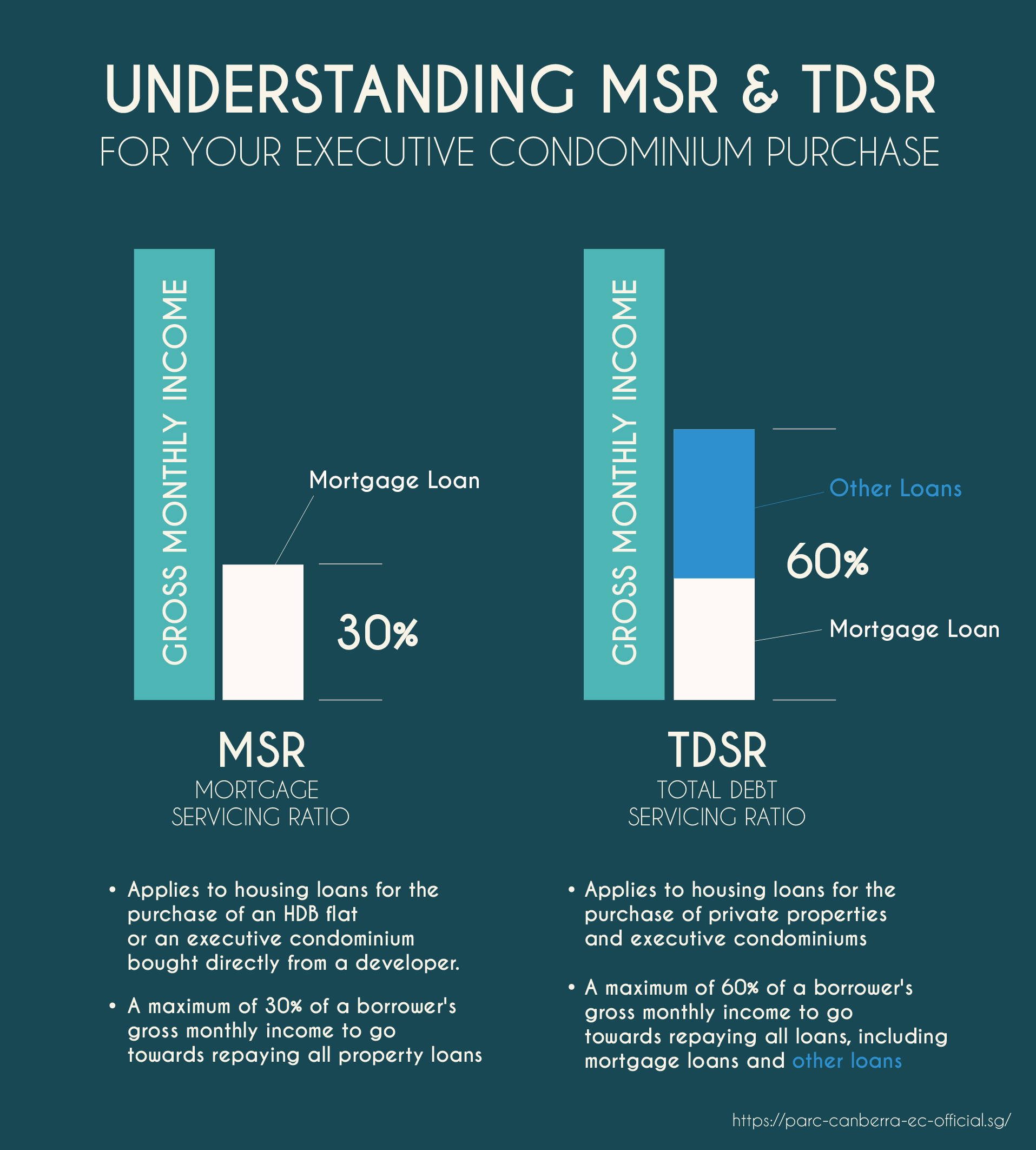

What is the Total Debt Servicing Ratio?

- The Total Debt Servicing Ratio is a maximum threshold set by MAS. However, FIs may grant property loans to borrowers whose TDSR exceeds the threshold on an exceptional basis, subject to enhanced credit evaluation.

- The TDSR threshold for property loans is set at a maximum of 60% of the borrower’s monthly income.

- It applies to housing loans for the purchase of private properties and executive condominiums

Calculating TDSR

- Under the TSDR guidelines, your monthly monthly debt obligations and gross monthly income will be taken into account

- A borrower’s TDSR is calculated using the following formula:

- (Borrower’s total monthly debt obligations / Borrower’s gross monthly income) x 100%

Monthly Debt Obligations

Monthly debt includes all outstanding debt obligations:

- Property-related loans, including the loan being applied for.

- Car loans.

- Student loans.

- Renovation loans.

- Credit card loans.

- Any other secured or unsecured loans, including revolving loans.

For more details, please refer to the MAS website here: Total Debt Servicing Ratio for Property Loans